Cryptocurrencies have recently transitioned from niche digital assets to mainstream financial instruments. As businesses and consumers increasingly embrace this digital revolution, understanding the mechanisms facilitating crypto transactions becomes essential. One such mechanism is the crypto payment gateway. This guide aims to demystify crypto payment gateways, exploring their functionality, benefits, challenges, and integration processes.

Understanding Crypto Payment Gateways

Definition and Functionality

A crypto payment gateway is a service that enables merchants to accept payments in cryptocurrencies such as Bitcoin, Ethereum, and others. Functioning similarly to traditional payment gateways, it processes, verifies, and facilitates the transfer of digital currencies from customers to merchants. This system ensures that crypto transactions are seamless, secure, and efficient.

How Crypto Payment Gateways Work

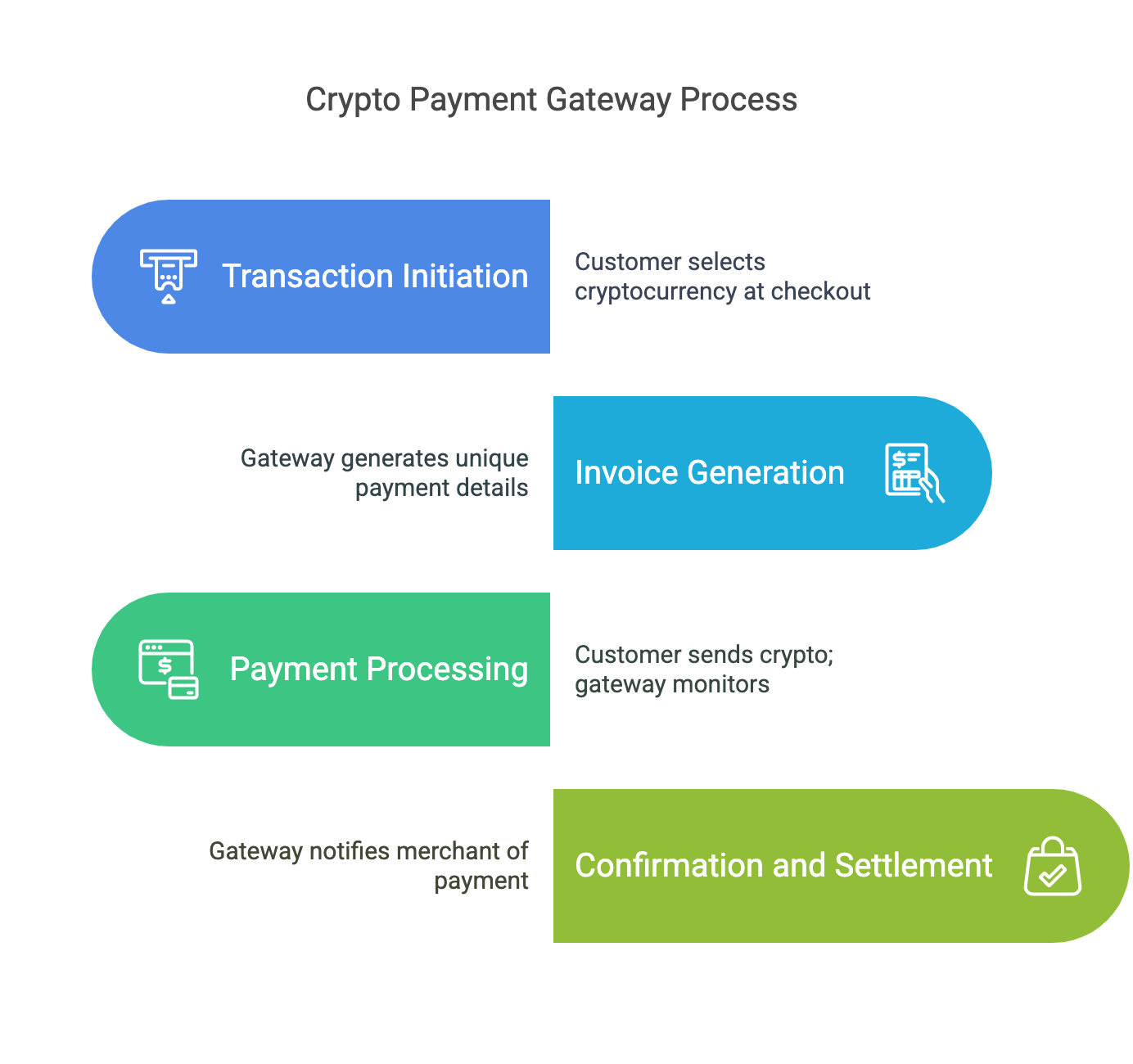

The operation of a crypto payment gateway involves several key steps:

Transaction Initiation: A customer selects a cryptocurrency as their payment method at checkout.

Invoice Generation: The gateway generates a unique wallet address or QR code for the payment, reflecting the exact amount due.

Payment Processing: The customer sends the cryptocurrency to the provided address. The gateway monitors the blockchain network to confirm the transaction.

Confirmation and Settlement: Upon confirmation, the gateway notifies the merchant of the successful payment. Depending on the merchant's preference, the received cryptocurrency can be settled in digital assets or converted to fiat currency.

This process leverages blockchain technology, ensuring transparency, security, and immutability of transactions.

Benefits of Using Crypto Payment Gateways

Integrating crypto payment gateways offers several advantages:

Lower Transaction Fees

Cost Efficiency: Cryptocurrency transactions often incur lower fees compared to traditional payment methods, especially for cross-border payments.

Increased Profit Margins: Reduced fees can lead to higher profit margins for businesses.

Faster Transaction Times

Swift Settlements: Crypto transactions can be processed in minutes, regardless of the parties' locations.

Improved Cash Flow: Faster payments enhance cash flow management for businesses.

Enhanced Security

Blockchain Integrity: The decentralized nature of blockchain technology provides robust security, reducing the risk of fraud and chargebacks.

Data Protection: Cryptographic protocols ensure that transaction data remains secure and tamper-proof.

Potential Drawbacks and Challenges

While crypto payment gateways offer numerous benefits, they also present certain challenges:

Volatility of Cryptocurrencies

Price Fluctuations: Cryptocurrencies are known for their volatility, which can affect the value of transactions between initiation and settlement.

Mitigation Strategies: Merchants can use gateways that offer instant conversion to fiat currencies, minimizing exposure to price swings.

Regulatory and Legal Considerations

Evolving Regulations: The regulatory environment for cryptocurrencies varies by jurisdiction and is continually evolving.

Compliance Requirements: Businesses must stay informed about local laws and ensure compliance when accepting crypto payments.

Popular Crypto Payment Gateways

Several platforms facilitate crypto payments for businesses:

Overview of Leading Providers

BitPay – Supports multiple cryptocurrencies and offers features like invoicing, merchant settlement in fiat currencies, and seamless integrations with major e-commerce platforms.

Coinbase Commerce – Enables merchants to accept crypto payments directly into their wallets, with no intermediaries and smooth integration options.

CoinGate – Provides a variety of tools, including payment buttons, APIs, and plugins for major e-commerce platforms, allowing for flexible payment processing.

MaxelPay – A rising crypto payment gateway that supports Bitcoin, Ethereum, BNB, USDT, and other cryptocurrencies. MaxelPay offers custom crypto payment gateway API integration and cryptocurrency payment gateway for woocommerce plugin solutions, making it ideal for businesses looking for a scalable and adaptable Web3 payment infrastructure.

MaxelPay stands out for its multi-currency support, enhanced security features, and custom integrations, making it a strong contender in the evolving crypto payment landscape.

Comparison of Services

Note: Features are subject to change; always refer to the official websites for the most current information.

How to Integrate a Crypto Payment Gateway into Your Business

Implementing a crypto payment gateway involves several steps:

Choosing the Right Provider

Consider the following factors:

Transaction Fees: Evaluate the cost per transaction and any additional fees.

Supported Cryptocurrencies: Ensure the gateway supports the digital currencies preferred by your customers.

Integration Options: Look for compatibility with your existing systems, such as APIs or plugins for your e-commerce platform.

Customer Support: Access to reliable support can assist in resolving issues promptly.

Technical Integration Steps

Sign Up: Create an account with the chosen payment gateway provider.

Obtain API Keys: Access the necessary credentials to integrate the gateway with your system.

Install Plugins or APIs: Depending on your platform, install the appropriate tools to facilitate transactions.

Configure Settings: Set preferences such as supported cryptocurrencies, settlement options, and notification settings.

Test Transactions: Conduct test payments to ensure the system operates correctly before going live.

For platforms like Shopify or WooCommerce, dedicated plugins can simplify this process. Custom-built websites may require direct API integration.

Real-World Examples of Crypto Payment Adoption

Businesses Embracing Crypto Payments

Sheetz: A convenience store chain that accepts Bitcoin and Ethereum, providing customers with more payment options.

Overstock: One of the first major retailers to accept cryptocurrency payments, helping drive mainstream adoption.

Microsoft: Allows users to add Bitcoin to their Microsoft accounts for purchasing digital content.

Tesla: Briefly accepted Bitcoin for vehicle purchases and continues exploring cryptocurrency payment options.

AirBaltic: A European airline that accepts Bitcoin for ticket bookings, showcasing crypto's utility in travel.

These businesses highlight the growing trend of integrating crypto payment solutions across industries.

Consumer Adoption Trends

The global adoption of cryptocurrency payments is rising. Key trends include:

Increased Awareness: A 2023 survey by PYMNTS found that over 40% of consumers are interested in using cryptocurrencies for everyday transactions.

Younger Demographic Preference: Millennials and Gen Z are more likely to use crypto payment options than older generations.

Cross-Border Transactions: Businesses operating internationally find crypto payments beneficial for reducing exchange rate complexities and banking fees.

Stablecoin Integration: Many consumers and businesses prefer using stablecoins like USDT and USDC to avoid volatility.

The Future of Crypto Payment Gateways

Emerging Trends

Integration of Stablecoins: More gateways now support stablecoins, reducing price volatility concerns.

DeFi and Smart Contracts: Decentralized finance (DeFi) solutions are influencing crypto payment gateway innovations, allowing automated and trustless transactions.

NFT and Metaverse Payments: As digital assets gain popularity, crypto payment platforms are expanding to include NFTs and metaverse-related transactions.

Central Bank Digital Currencies (CBDCs): Governments are exploring digital currencies that may work alongside or compete with existing crypto payment solutions.

Market Projections

Market Growth: The global crypto payment gateway market is projected to grow at a CAGR of 22.8% between 2023 and 2030.

Increased Merchant Adoption: More small businesses and enterprises are integrating crypto payments to cater to a tech-savvy customer base.

Regulatory Clarity: As governments refine crypto regulations, businesses will gain more confidence in accepting cryptocurrency payments.

Conclusion

The rise of crypto payment gateways signals a shift toward a more decentralized and efficient financial system. As blockchain technology continues to evolve, we can expect even greater innovations in digital payments, making cryptocurrencies more accessible and practical for everyday use.

Frequently Asked Questions (FAQs)

1. What is a crypto payment gateway?

A crypto payment gateway is a service that allows merchants to accept cryptocurrency payments. It processes transactions, verifies them on the blockchain, and settles payments in digital or fiat currency.

2. How does a crypto payment gateway work?

The gateway generates a wallet address or QR code for payment, verifies transactions on the blockchain, and then settles funds according to merchant preferences.

3. Are crypto payment gateways secure?

Yes! Crypto transactions use blockchain encryption and decentralization, making them highly secure. Unlike traditional payment methods, crypto transactions are immutable and resistant to fraud.

4. Can I convert crypto payments to fiat currency?

Yes! Many crypto payment gateways offer automatic conversion to fiat currencies like USD, EUR, or GBP, reducing exposure to crypto volatility.

5. What are the best crypto payment gateways?

Some top gateways include:

BitPay – Supports multiple cryptocurrencies and fiat settlement.

Coinbase Commerce – Direct wallet-to-wallet payments with no middleman.

CoinGate – Offers plugins for e-commerce platforms and multiple payment options.

6. Is it legal to accept cryptocurrency payments?

It depends on your country. While many countries allow crypto payments, others have restrictions. Always check local regulations before integrating a crypto payment gateway.

Write a comment ...